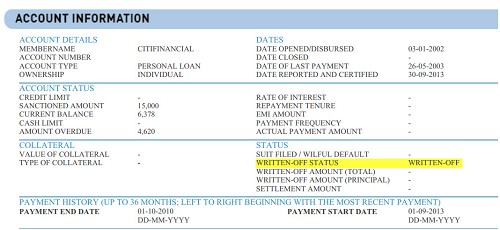

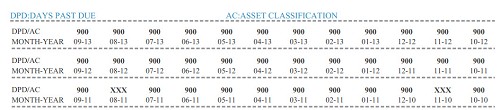

I took a Personal loan of Rs.15,000 from "The Associates" Bangalore in 2002. EMI: Rs.954 for 20 months. I was able to pay 3 months and I coudnt continue . Meantime the company closed and taken over by Citibank. Due to job loss and struggle for even to meet common houshold expense I count not pay. I moved to Chennai with family in 2005. I got job and managing household now. The same time I had HSBC credit card (Rs.15000) even that I coudnt pay. after 4 yrs HSBC bank somehow traced me and asked for repayment of credit card dues (Rs.30000) I asked them I coudnt pay the said amount but would pay my credit limit amount by instalment after long conversations they accepted my request and sent me a letter for settlement. I gave them 3 post dated cheque for Rs.5000 each and next 3 months it cleared smoothly.

Citibank never called me for personal loan payment so I left it. Now after 10 yrs I recd a letter from Citibank which they sent my Cibil score statement which states that personal loan taken in 2002 is not yet cleared. They have asked me to contact bank regarding clarification.

How do i proceed on this?

Pl advise