REPORTABLE

IN THE SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION

CIVIL APPEAL NO. 1557 OF 2004

Export Credit Guarantee Corpn. …Appellant

of India Ltd.

Versus

M/s Garg Sons International …Respondent

With

Civil Appeal Nos. 1553, 1548, 1555, 1556, 1549, 1552, 1551,

1558, 1550, 1559, 1543, 1542, 1546, 1544, 1545 and 1547 of 2004.

J U D G M E N T

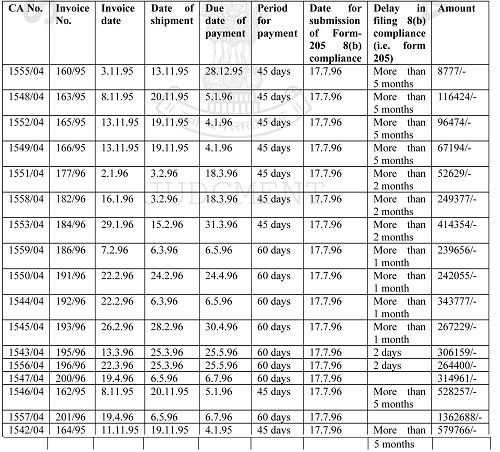

Dr. B.S. CHAUHAN, J.

1. All the above-mentioned appeals have been preferred against the common impugned judgment and order dated 18.2.2003 passed by the National Consumer Disputes Redressal Commission, New Delhi, in Revision Petition Nos. 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 933 of 2002 and F.A.238, 246 and 247 of 2001.

2. Facts and circumstances giving rise to these appeals are that:

A. The appellant herein, Export Credit Guarantee Corporation of India Ltd., (hereinafter referred to as `the insurer’), is a government company, which is in the business of insuring exporters. Respondent, M/s Garg Sons International, on 23.3.1995 purchased a policy for the purpose of insuring a shipment to foreign buyers i.e. M/s Natural Selection Co. Ltd. of UK, and the said buyer committed default in making payments towards such policy from 28.12.1995 onwards, with respect to the said consignment.

B. The insured, that is M/s Garg Sons International, sought enhancement of credit limit to the tune of Rs.50 lakhs with respect to the said defaulting foreign importer. Subsequently, he presented 17 claims.

C. The insurer rejected all the above mentioned claims on the ground that the insured did not ensure compliance with Clause 8

(b) of the insurance agreement, which stipulated the period within which the insurer is to be informed about any default committed by a foreign importer.

D. Thus, the insured then filed several complaints before the State Disputes Redressal Commission, to which the insurer filed replies. The State Disputes Redressal Commission adjudicated upon the case and disposed of the said complaint, vide order dated 4.6.2001, directing the insurer to make various requisite payments due under different claims, with 9 per cent interest and litigation expenses etc.

E. Being aggrieved against the orders passed in all 17 claims, the insurer preferred appeals under Section 19 of the Consumer Protection Act, 1986, before the National Consumer Disputes Redressal Commission, wherein the impugned judgment and order was disputed, stating that it was evident from the said judgment that 11 claims had been rejected and that 5 claims made by the insured were accepted.

Hence, both the parties preferred these appeals.

3. Shri Santosh Paul, learned counsel appearing on behalf of the insurer, has submitted that the insured failed to communicate information pertaining to the default made by the foreign importer, to the insurer, within the stipulated period, which was fixed as 45 days from the date on which the payment became due, and thus, failed to ensure compliance with the mandatory requirement under Clause 8 (b), owing to which, the claims with respect to which the said information was not furnished within the time period stipulated in the agreement, have wrongly been allowed.

Moreover, it is evident from the judgment that only 5 claims made by the insured were accepted, and that 11 claims were rejected, though in the said order, only 9 claims were found to be rejected and 4 were shown as accepted. As the only numbers of 4 revisions have been mentioned, stating that only these were worth acceptance, and those of 9 revisions have been mentioned, as those that were rejected, which was all stated to show that there were typographical errors in the judgment itself.

In addition thereto, there were also certain appeals and thus, the order was required to be modified to the extent that only two claims which were made in respect of Civil Appeal Nos. 1547 of 2004 and 1557 of 2004, wherein all statutory requirements were complied with deserve to be allowed, while the others, owing to default on the part of the insured, are liable to be rejected.

4. On the other hand, Shri Satinder Singh Gulati, learned counsel appearing on behalf of the insured, has submitted that admittedly, there is in fact a typographical error in the impugned judgment and order, and has stated that the claims of the insured, with respect to which there has been no default on the part of insured, i.e., some claims have wrongly been rejected. Therefore, the appeals filed by him i.e. Civil Appeal Nos. 1559, 1544, 1545, 1543 and 1546 of 2004 should be allowed and the other appeals, should be rejected accordingly.

5. We have considered the rival submissions made by learned counsel for the parties and perused the record.

6. Relevant clauses of the insurance policy dated 23.3.1995, read as under:

“8. Declarations:

(a) Declaration of shipments :- …………

(b) Declaration of overdue payments: The insured shall also deliver to the Corporation, on or before the 15th of every month, declaration in the term prescribed by the Corporation, of all payments which remained wholly or partly unpaid for more than 30 days from the due date of payment in respect of shipments made within the policy period and such declaration shall continue to be rendered to the Corporation even after the expiry of the policy period so long as any such payment remains overdue.

xx xx xx

19. Exclusion of Liability: Notwithstanding anything to the contrary contained in this policy, unless otherwise agreed to by the Corporation in writing, the Corporation shall cease to have any liability in respect of the gross invoice value of any shipment or part thereof, if:

(a) the insured has failed to declare, without any omission, all the shipments required to be declared in terms of clause 8(a) of the policy and to pay premium in terms of clause 10 of the policy;

(b) the insured has failed to submit declaration of overdue payments as required by clause 8(b) of the policy; or

(c) ……………”

7. If both the conditions referred to hereinabove are read together, it becomes evident that the insured must make a declaration in the prescribed form (Form No. 205), on the 15th of every month as regards whether or not, there has been any default committed by the foreign importer, either in part, or in full, for a period exceeding 30 days from the date on which the payment fell due, with respect to shipments made within the policy period. Non-compliance with the said term(s) of contract, will exonerate the insurer of all liability in this regard.

8. It is a settled legal proposition that while construing the terms of a contract of insurance, the words used therein must be given paramount importance, and it is not open for the Court to add, delete or substitute any words. It is also well settled, that since upon issuance of an insurance policy, the insurer undertakes to indemnify the loss suffered by the insured on account of risks covered by the policy, its terms have to be strictly construed in rder to determine the extent of the liability of the insurer.

Therefore, the endeavour of the Court should always be to interpret the words used in the contract in the manner that will best express the intention of the parties. (Vide: M/s. Suraj Mal Ram Niwas Oil Mills (P) Ltd. v. United India Insurance Co. Ltd., (2010) 10 SCC 567).

9. The insured cannot claim anything more than what is covered by the insurance policy. “…the terms of the contract have to be construed strictly, without altering the nature of the contract as the same may affect the interests of the parties adversely.” The clauses of an insurance policy have to be read as they are… Consequently, the terms of the insurance policy, that fix the responsibility of the Insurance Company must also be read strictly. The contract must be read as a whole and every attempt should be made to harmonize the terms thereof, keeping in mind that the rule of contra proferentem does not apply in case of commercial contract, for the reason that a clause in a commercial contract is bilateral and has mutually been agreed upon. (Vide : Oriental Insurance Co. Ltd. v. Sony Cheriyan AIR 1999 SC 3252; Polymat India P. Ltd. v. National Insurance Co. Ltd., AIR 2005 SC 286; M/s. Sumitomo Heavy Industries Ltd. v. Oil & Natural Gas Company, AIR 2010 SC 3400; and Rashtriya Ispat Nigam Ltd. v. M/s. Dewan Chand Ram Saran AIR 2012 SC 2829).

10. In Vikram Greentech (I) Ltd. & Anr. v. New India Assurance Co. Ltd. AIR 2009 SC 2493, it was held :

“An insurance contract, is a species of commercial transactions and must be construed like any other contract to its own terms and by itself…. The endeavour of the court must always be to interpret the words in which the contract is expressed by the parties. The court while construing the terms of policy is not expected to venture into extra liberalism that may result in rewriting the contract or substituting the terms which were not intended by the parties.”

(See also: Sikka Papers Limited v. National Insurance Company Ltd & Ors. AIR 2009 SC 2834).

11. Thus, it is not permissible for the court to substitute the terms of the contract itself, under the garb of construing terms incorporated in the agreement of insurance. No exceptions can be made on the ground of equity. The liberal attitude adopted by the court, by way of which it interferes in the terms of an insurance agreement, is not permitted. The same must certainly not be extended to the extent of substituting words that were never intended to form a part of the agreement.

12. The instant case is required to be considered in light of the aforesaid settled legal propositions. The requisite record reveals the factual matrix as under:

13. The aforesaid chart clearly establishes that the insured failed to comply with the requirement of clause 8(b) of the agreement informing the insurer about the non-payment of outstanding dues by the foreign importer within the stipulated time except in two cases.

14. Thus, we are of the view that only two claims which are subject-matters in Civil Appeal Nos. 1547 and 1557 of 2004 deserve to be allowed. The others are dis-allowed.

With these observations, all 17 appeals stand disposed of.

..………………………….J.

(Dr. B.S. CHAUHAN)

.…………………………..J.

(V. GOPALA GOWDA)