Agricultural income in India is categorised as a source of income and includes:

- income from sources that comprise agricultural land,

- income from buildings on or related to an agricultural land and

- commercial produce from an agricultural land.

Agricultural income is defined under section 2(1A) of the Income Tax Act and such income earned by a taxpayer in India is exempt under Section 10(1) of the same. Here we list 5 issues related to agricultural income and their answers, along with the relevant case laws.

Whether income derived from sale of forest produce of spontaneous growth is income from agriculture?

Short answer: No

Case: CIT vs. Raja Benoy Kumar Sahas Roy | Supreme Court | Cited 190+ times

Reasoning: The Supreme Court in this case discussed the question of what amounted to carrying out of agriculture. After discussing numerous precedents and authorities, the court observed that agriculture involved certain basic operations which were needed to be carried out on the land for such activity to be categorized as agriculture. Another part involved taking care of produce from the land. While the two activities conjunctively would no doubt amount to agriculture, just the performance of the latter part would not render the activity as agricultural.

Whether dividend received as a shareholder of a tea company can be classified as income from agriculture?

Short answer: No.

Case: Mrs. Bacha F. Guzdar vs. CIT | Supreme Court | Cited 118+ times

Reasoning: The court ruled that for income to be called as income from agriculture it had to berevenue derived from land. The court made a pertinent distinction by observing that the right of the shareholder was limited simply to a share in the profits of the company and not ownership of the property of the company. Hence, dividend income, even if it arose out of agriculture, would simply be a share of the profits for the shareholder and hence could not be classified as agricultural income.

Whether interest on money borrowed for purchase of a plantation is allowable as a deduction from agricultural income?

Short Answer: Yes

Case: State of Madras vs. G.J. Coelho | Supreme Court | Cited 82+ times

Reasoning: The court proceeded on a two-pronged approach to determine the outcome in this case. Firstly, it held that the expenditure incurred by payment of interest was a revenue and not capital in nature and hence would be liable for deduction. Secondly, it would not amount to personal expenditure as even though the obligation to pay was a personal obligation, it was wholly related to the business of the assessee.

Whether compensation received for loss of agricultural income can be classified as agricultural income?

Short answer: No

Case: Malabar Industrial Company Ltd. Vs. CIT | Supreme Court | Cited 214+ times

Reasoning: The assessee in this case sold a plantation for which it was to receive regularly scheduled payment. Since the buyer failed to adhere to the schedule, it paid a certain sum of money, allegedly as compensation for loss of agricultural income. The court held that such a statement could not be accepted simply on the basis of a claim made by the assessee. Moreover, the assessee had already stopped agricultural operations on the land and hence the amount could not reasonably be said to be compensation for loss of agricultural income.

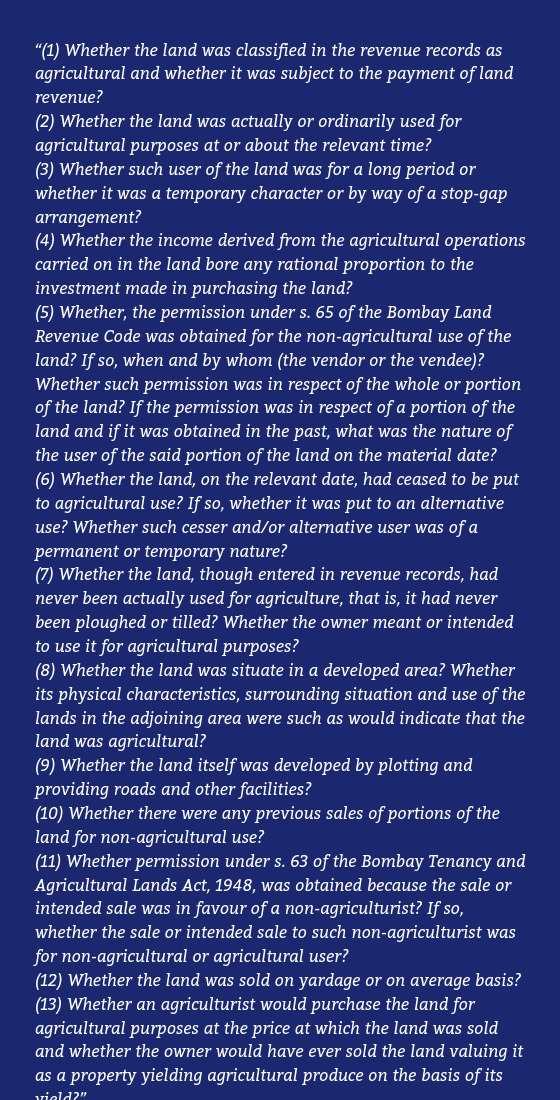

How should the court determine whether a piece of land is agricultural land or not?

Case: CIT vs. Siddharth J. Desai | Gujarat High Court | Cited 66+ times

Reasoning: The court determined that the following factors needed to be taken in to consideration while deciding the nature of land –

----------------------------------------------------------------------------------------------------

Riverus is a legal research and analytics tool for income tax. We use modern technologies like machine learning to make your research experience fast and efficient. Using analytics, you can discover insights, construct a strategy, and mitigate risks.

The product enables tax professionals to draw valuable insight and information from more than 4 lakhs judgments and orders(reported + unreported) given by courts and tribunals.

The product enables tax professionals to draw valuable insight and information from more than 4 lakhs judgments and orders(reported + unreported) given by courts and tribunals.

Many accountants and lawyers in western countries use machine learning powered research tools today. It helps them provide better service, and build a more satisfied customer base. Not to mention the efficiency and time savings it brings in. Now, with Riverus, such technology is at your beck and call and you can use it to win more customers and delight the existing ones.

All CAclubindia members get a free trial of Riverus, write us on hello@riverus.in for more information.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others