1.There is no cost involved in filing complaint with Baking ombudsman and it is free and available on line., so

a)first file the copy and paste complaint as grievance in on line portal of the bank,

b)Then, by making suitable modifications file on line complaint in Banking Ombudsman of your jurisidiction. There is no prescsribed format and immediately after filing on line grievance to Ombudsman, send hard copies by Regd ack due under copy to concerned Bank.

2.That means in one envelope you enclose the original notice and also the copy of complaint filed before banking ombudsman with such filling of reference no.

3.The DF referred to is District Consumer Forum of your district. I still have my own doubts whether it can entertain the complaint or not as it depends on constitution of your trading activity. However, making a try costs nothing as the complaint is one and the same both for DF and Ombudsman. Use followin simple format and modify the title.

Complaint before Banking Ombudsman or /Consumer Forum.

No.

1.Name of the Complainant and address.

2.Name of the Bank /Opposite party (DF)

3.Brief facts: a)Complainant has applied and secured Bank Guarantee for Rs.... on......in favour of Rs........................and the duration of the BG is upto...

b)Bank has collected Commission of Rs........

c)Bank has taken Fixed deposit No.............for Rs.............fvg. as security for BG issuesd

d)Complainant has obtained the original Bank guarantee issued by the Bank and surrendered the same to Bank on................with acknowledgment (Encl 1) and has been requesting for release of lien on said fixed deposit for Rs.....as any amount is more precious for individual/trader.

e)Bank, even after receiving original BG is not releasing lien and has been harassing the complainant with out a valid reason. In case of any doubts, to avoid such risks, Bank can write to the beneficiary and can obtain clarification.

f)Bank is neither obtaining such clarification from beneficiary about the non enforceability of the BG nor lifting lien and causing inconvenience and irreparable loss to complainant. It is not clear as to whether Bank has reversed the contingent liability in books of accounts or not after receiving original BG issued by them in return as their record.

g)As Bank is subjecting complainant to harssment without any legal justification, this complaint.

4)PRAYER: Complainant prays through this for directions / orders to Bank.

a)For immediate lifting of lien on fixed deposit offered as security, as there is no obligation to them on behalf of applicant.

b)For awarding of costs of Rs.5,000/- for incidental expenses in getting back the Bank guarantee original and as applicant is disabled in liquidating the deposit to repay to his personal obligation towards loss of eligible interest on borrowing @ 18% on Rs.....

c)For awarding compensation of Rs.50,000/- for subjecting complainant to harassment and withholding fixed deposit without any valid legal and justified reasons.

Verification: I,..............................s/o......................aged..................resident of.........................solemnly affirms and state that above facts are true to my knowledge and facts. This complainant is filed as Bank is rejecting to lift the lien since....months.

Complainant.

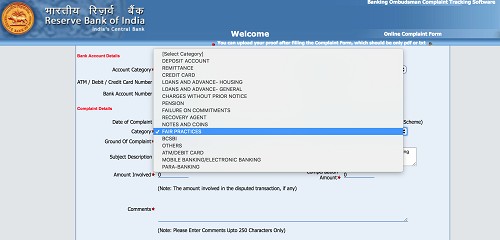

What should be account subcategory? Should it be Current or Fixed? The FD is issued from our Current a/c maintained with the same bank & the BG is issued from this FD.

What should be account subcategory? Should it be Current or Fixed? The FD is issued from our Current a/c maintained with the same bank & the BG is issued from this FD.