Dear Experts,

Please share your expert opinion along with legal precedents and judgements if any on the below issue.

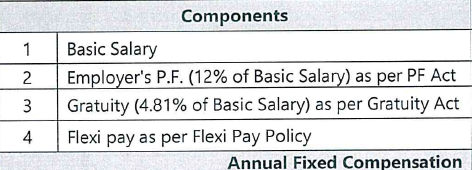

My employer has Shown Gratuity deduction as pert of the Fixed salary breakup and has deducted the same from the monthly salary payments. I completed around 1 year and six months of service. upon leaving the organization the employer is denying the Gratuity Payment where as my argument is that it is deducted from Fixed salary so it should be paid as Ex-Gratia from the salary if not as Gratuity.

Any legal provision on this.

Regards

Mayank Jain