e-Filing of Returns

(1) What is E-Filing?

* The process of electronically filing Income tax returns through the internet is known as e-filing.

* It is mandatory for companies and Firms requiring statutory audit u/s 44AB to submit the Income tax returns electronically for AY 2007-08.

* E-filing is possible with or without digital signature.

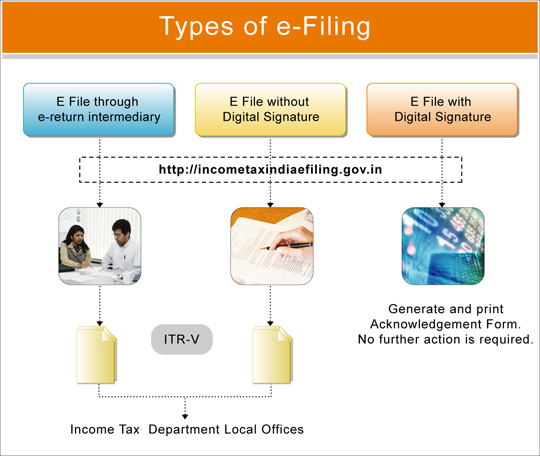

(2) Types of E-Filing

* There are three ways to file returns electronically.

* Option 1: Use digital signature, in which case no further action is required.

* Option 2: File without digital signature, in which case ITR-V form is to be filed with the department. This is a single page receipt cum verification form.

* Option 3: File through an e-return intermediary who would do eFiling and also assist the Assessee file the ITR -V Form.

(3) Types of E-Filing

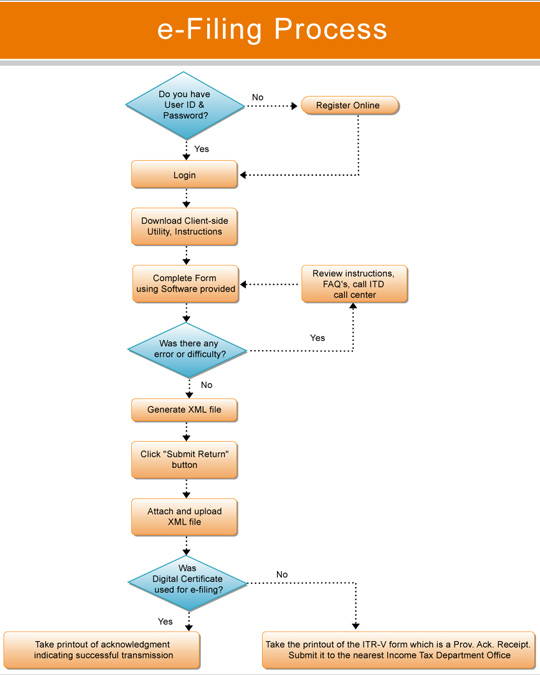

(4) E filing process :

This is explained below with the help of a flow chart.

(5) Change in the procedure of e- filing for 2008-09

Type Change

For digitally signed returns No Change

Paper Returns -Two step Procedure After uploading data -instead of filing paper return assessee to file verification form called ITR-V (Combination of Acknowledgement of e-return and verification

Paper Returns - through e-intermediaries

(6) e-Filing Process At a glance

* Select appropriate type of Return Form .

* Download Return Preparation Software for selected Return Form.

* Fill your return offline and generate a XML file.

* Register and create a user id/password .

* Login and click on relevant form on left panel and select "Submit Return".

* Browse to select XML file and click on "Upload" button .

* On successful upload acknowledgement details would be displayed. Click on "Print" to generate printout of acknowledgement/ITR-V Form.

* Incase the return is digitally signed , on generation of "Acknowledgement" the Return Filing process gets completed. Assessee may take a printout of the Acknowledgement for his record.

* Incase the return is not digitally signed , on successful uploading of e-Return, the ITR-V Form would be generated which needs to be printed by the tax payers. This is an acknowledgement cum verification form. The tax payer has to fill-up the verification part and verify the same. A duly verified ITR-V form should be submitted with the local Income Tax Office withing 15 days of filing electronically. This completes the Return filing process for non-digitally signed Returns.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Taxation