What Is Business Valuation?

The Business Valuation is a process and a set of procedures used to estimate the economic value of a stakeholder's interest in a business. Valuation is used by financial market participants to determine the price they are willing to pay or receive to affect a sale of a business. To determine the value of any business, the reasons for and circumstances surrounding the business valuation must be taken into consideration.

Key Ingredients of Business Valuation:

Price is not the same as Value - the Value of a business, by whatever business valuation method it is obtained, is not the selling price of the business.

Value varies with Person, Purpose and Time - the Value is a subjective term and can have different connotations meaning different things to different people and the result will not be the same, should the context or time changes.

Transaction concludes at Negotiated Price - Valuation is dependent on buyer and seller expectations and subsequent negotiations and the Transaction happens at negotiated price only.

Valuation is hybrid of Art and Science - Valuation is more of an art and not an exact science. The art is of Judgment and Science is Statistics.

Reasons for conducting Business Valuation

- It is used in mergers and acquisitions to assist business owners in determining value of the business or maximise value when considering a sale, merger, acquisition etc.

- When a company goes for Initial Public Offering (IPO), for generating capital for its business. Valuation is done to evaluate fair value of such a stock.

- Voluntary assessment - for the management to know the true worth and fair value of the business, for internal management purpose as well for future decision making.

Generally Acceptable Company Valuation Methods

There are three fundamental ways to measure what a business is worth:

- Asset Approach;

- Income Approach; and

- Market Approach

Asset Approach

The asset approach is the simplest approach of all, where only the assets of a company are being scrutinized to obtain the value of the business. The result that we get after calculation here is Net Asset value (NAV)

The following are the methods to determine Company Valuation under the Asset Approach:

Book Value Method -It is based on the balance sheet review of assets and liabilities; Book value is also the net asset value of a company, calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

Replacement Cost Method -It is based on current set up cost of a plant of similar age, size and capacity. A replacement cost is the cost to replace an asset of a company at the same or equal value, and theassetto be replaced could be a building, investment securities, accounts receivable or liens. The replacement cost can change, depending on changes in market value of the asset and any other costs required to prepare the asset for use.

Liquidation Value Method -It is based on estimated realizable value of various assets. Liquidation value is the total worth of a company's physical assetswhen it goes out of business or if it were to go out of business. Liquidation value is determined by assets such as real estate, fixtures, equipment and inventory Intangible assets are not included in a company's liquidation value.

Generally, the Net Asset Value reflected in books does not usually include intangible assets enjoyed by the business and are also impacted by accounting policies which may be discretionary at times. NAV is not perceived as a true indicator of the fair business value. However, it is used to evaluate the entry barrier that exists in a business and is considered viable for companies having reached the mature or declining growth cycle and also for property and investment companies having strong asset base.

One important aspect to remember is that this method is to be avoided while calculating the valuation in sole proprietorship since it is difficult to separate the assets that were used for personal and business purposes.

Income Approach

The Income based method of valuations are based on the premise that the current value of any business is a function of the future value that an investor can expect to receive from purchasing all or part of the business.

The following are the Company Valuation Methods determined under Income Approach:

Discounted Cash Flow Method (DCF)- DCF expresses the present value of the business as a function of its future cash earnings capacity. In this method, the appraiser estimates the cash flows of any business after all operating expenses, taxes, and necessary investments in working capital and capital expenditure is being met. Valuing equity using the free cash flow to stockholders requires estimating only free cash flow to equity holders, after debt holders have been paid off.

This approach catches the future business potential of a company and is very prevalent in the service industry. Also, this method is often considered the best method to evaluate a business. The nature of the calculations used inhere, analysis make it more properly suited for use in evaluating certain types of industries or companies. DCF analysis is designed to give an evaluation of a company's current value, commonly designated as "net present value," by projecting its future free cash flows, or profits. Larger and more firmly established companies with fairly steady growth histories to use as the basis for projections of future growth are better suited to evaluation by DCF analysis.

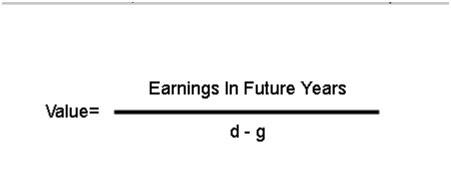

Capitalization of Earning Method -It determines the value of an organization by calculating the net present value (NPV)of expected future profits or cash flows.. The capitalization of earnings estimate is determined by taking the entity's future earnings and dividing them by the capitalization rate (cap rate). This is an income-valuation approach that determines the value of a business by looking at the current cash flow, the annual rate of return and the expected value of the business.

Here d stands for Discount Rate and g stands for Growth Rate.

The capitalization of earnings approach helps investors determine the potential risks and return of purchasing one company rather than another to decide which may offer the best value for the investor's money.

Market Based Approach

In this method, value is determined by comparing the subject, company or assets with its peers or transactions happening in the same industry and preferably of the same size and region. This is also known as Relative Valuation Method.

The following are the methods to determine Business Valuation under Income Approach:

Comparable Companies Multiples Approach/Comparable Company Analysis

Market Multiples of Comparable Listed Companies are computed and applied to the Company being valued to arrive at a multiple based valuation.

The below describes the way the calculation is done:

1. Select Comparable Companies

- Publicly traded companies that are similar to the subject company. They should be of same or similar industry

- Calculate Relative Value Measures

- Enterprise value multiples

- Price multiples - Price / Earnings (P/E), Price / Cash Flow (P/CF), Price / book value of equity (P/BV), Price/ Sales (P/S)

- Apply Metrics to Target

- Judgment needed to select appropriate metric

- Estimate Takeover Price - with takeover premium added (if Mergers/Acquisition is involved)

Illustration:

Suppose an analyst has gathered the following information on the target company, the ABC Company:

|

ABC Company |

Value |

Averageof comparables |

Average |

|

Earnings |

$10 million |

P/E of comparables |

30 times |

|

Cash flow |

$12 million |

P/CF of comparables |

25 times |

|

Book value of equity |

$50 million |

P/BV of comparables |

2 times |

|

Sales- |

$100million |

P/S of comparables |

2.5 times |

If the typical takeover premium is 20%, what is the ABC Company's value in a merger using the comparable company approach?

Assuming that the average of the values from the different multiples is most appropriate:

|

Using comparables' multiples |

Value |

Estimated stock value |

|

Earnings - |

$10 million |

× 30 = $300 million |

|

Cash flow - |

$12 million |

× 25 = $300 million |

|

Book value of equity- |

$50 million |

× 2 = $100 million |

|

Sales- |

$100 million |

× 2.5= $250 million |

Average = $(300+300+100+250)/4 = $237.5 million

Estimated takeover price of the ABC Company = $237.5 million × 1.2 = $285 million

(Note: The multiplier of 1.2 is from the takeover premium: 1 + 0.20 = 1.2)

Comparable Transaction Multiples Method/Comparable Transaction Analysis

This technique is mostly used for valuing a company for M&A, the transaction that have taken place in the Industry which are similar to the transaction under consideration are taken into account.

The process of valuation is enumerated as follows:

• Collect information on recent takeover transactions of comparable companies.

• Calculate multiples for comparable companies (e.g., P/E, P/CF).

• Estimate takeover value based on multiples.

For Example:

Suppose an analyst has gathered the following information on the target company, the MNO Company:

|

MNO Company |

Value |

Comparables |

Average |

|

Earnings- |

$10 million |

P/E of comparables- |

15 times |

|

Cash flow- |

$12 million |

P/CF of comparables- |

20 times |

|

Book value of equity- |

$50 million |

P/BV of comparables- |

5 times |

|

Sales- |

$100 million |

P/S of comparables- |

3 times |

Estimate the value of the MNO Company using the comparable transaction analysis, giving the cash flow multiple 70% and the other methods 10% each. Pl refer below for calculation.

|

Comparables' transaction multiples |

Value |

Estimated stock value |

|

Earnings - |

$10 million |

× 15 = $150 million |

|

Cash flow - |

$12 million |

× 20 = $240 million |

|

Book value of equity- |

$50 million |

× 5 = $250 million |

|

Sales- |

$100million |

× 3 = $300 million |

$238 million

The other mode of valuation here is comparable transaction analysis is the EV-to-EBITDA multiple. EV is enterprise value and EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA is usually measured on an LTM (last twelve months) basis. A comparable transaction approach is generally used in conjunction with other valuation techniques.

Difference between the comparable transaction analysis and the comparable company analysis- The company analysis uses comparables that are similar but that may or may not be involved in M&A. The comparable transaction analysis uses multiples only of recent transactions of comparable companies.

Market Value Approach -The Market Value method is generally the most preferred method in case of frequently traded Shares of Companies listed on Stock Exchanges having nationwide trading as it is perceived that the market value takes into account the inherent potential of the Company.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Corporate Law