Synopsis

This article provides an in-depth analysis of motor accident claims and contributory negligence in India, focusing on recent judicial interpretations, the role of technology, and global comparative perspectives. It examines how contributory negligence is assessed in courts, emphasizing the Supreme Court’s rulings that require clear, corroborative evidence rather than assumptions. The article also discusses the growing role of artificial intelligence in accident reconstruction and claims processing, highlighting both its benefits and challenges in ensuring fair and accurate liability determinations.

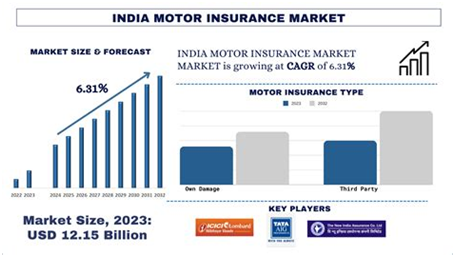

The economic impact of road accidents, which cost India 3-5% of its GDP annually, is analyzed through the lens of insurance claim trends and settlement ratios, shedding light on how insurers assess contributory negligence and its implications for compensation. Additionally, the article explores judicial enforcement challenges, delays in accident claim settlements, and the need for fast-track courts to expedite justice for victims.

Legal reforms under the Motor Vehicles (Amendment) Act, 2019 are also discussed, with a focus on penalty enhancements, protections for good Samaritans, and electronic enforcement mechanisms. The article concludes by recommending a multi-faceted approach, including stricter law enforcement, AI-driven traffic monitoring, better road infrastructure, and a robust judicial mechanism to ensure timely compensation and accountability.

Introduction

One of the toughest aspects of tort law is establishing liability in motor accidents. The courts must carefully analyze whether the accident results from the sole negligence of one party or from more than one party.

Contributory negligence comes into play when a claimant's act causes the accident, which has an effect on quantum of the award. The doctrine has been extensively argued in Indian law, with the courts reaffirming that contributory negligence needs to be established by direct and corroborative evidence and not assumed or inferred.

The Supreme Court ruling in Prabhavathi & Ors. v. Bangalore Metropolitan Transport Corporation throws a lot of light on how contributory negligence is to be ascertained. In rejecting fanciful deductions from compensation on the basis of unsubstantiated claims of negligence, the ruling emphasizes the role of evidence-based judicial logic.

Nevertheless, much remains to be answered about the general implications of contributory negligence, especially where there are several claimants, criminal cases, and insurance cases.

This longer analysis seeks to consider contributory negligence outside of its standard paradigm, assessing its use in sophisticated accident situations, its intersection with criminal law, and its effect on insurance litigation and economic policy.

Case Analysis: Prabhavathi & Ors. v. Bangalore Metropolitan Transport Corporation

Background of the Case

The Prabhavathi & Ors. case. v. Bangalore Metropolitan Transport Corporation was based on a tragic motor accident on June 6, 2016, when a 38-year-old motorcyclist named Boobalan was killed after he was run over by a Bangalore Metropolitan Transport Corporation bus.

After his premature death, his legal successors, that is, his wife and children, made a claim for compensation under the Motor Vehicles Act, 1988, stating that the accident had occurred solely on account of the negligent and rash driving of the BMTC bus driver. The claimants had argued that the dependents suffered a significant financial loss as a result of the deceased's passing and that he was an earning family member who received a consistent monthly income.

Based on the deceased's monthly pay and expected earnings, the claimants initially sought ₹3,00,00,000 in compensation. Using wage and reliance estimates, the Motor Accidents Claims Tribunal granted ₹75,97,060 in compensation.

The Karnataka High Court, which heard the BMTC's appeal of the decision, changed the order by reducing the expected monthly income to ₹50,000 and granting the dead a 25% contributory negligence award. As a result, the payout was adjusted to ₹77,50,000. The claimants were unhappy with this change and went to the Supreme Court to challenge the contributory negligence finding and request the return of the previous award.

Legal Issues Raised

The case essentially posed two important questions of law: first, whether contributory negligence can be presumed absent direct evidence, and second, whether the High Court's alteration of the deceased's estimated income was arbitrary and contrary to settled principles of determination of compensation. The Supreme Court's consideration was on whether the late had caused the accident by his own actions and whether the award should have been cut based on the assumptions of income made by the High Court.

Supreme Court's Judgment on Contributory Negligence

The Supreme Court held in favor of the claimants, highlighting that contributory negligence can only be implied where there is cogent, corroborative evidence. The Court repeated that liability should be decided by factual findings and not on speculative grounds.

In the absence of clear evidence showing that the deceased had been recklessly driving or defying traffic standards, the High Court's imposition of 25% contributory negligence was held to be incorrect. The Court explained that the onus of establishing contributory negligence lies with the respondent (BMTC) and that presumptions or allegations alone cannot be used as a reason to cut compensation.

In deciding this, the Court used the precedent established in Jiju Kuruvila & Ors. v. Kunjujamma Mohan & Ors. (2013), which ruled that contributory negligence should be supported by definite evidence. In addition, the Court cited Raj Rani & Ors. v. Oriental Insurance Co. Ltd. & Ors. (2009), again asserting that in situations where the claimant is dead, the courts have to be cautious before holding someone liable who cannot defend himself anymore. The decision reaffirmed that in the absence of unmistakable evidence, the benefit of doubt needs to be given to the claimant and not let the respondent escape by unsubstantiated arguments.

Restoration of the Assessed Income of the Deceased and Compensation Calculation

Besides contributory negligence, another important issue in the case was the reduction of the assessed income of the deceased by the High Court. The Supreme Court faulted the High Court for making an arbitrary decision to reduce the monthly income from ₹62,725 to ₹50,000, arguing that compensation calculations should be done on the basis of verifiable financial records and not judicial assumptions. The Court restated the principle that if salary slips, tax returns, and bank statements are available, these should be used as the foundation for assessing income to avoid courts making arbitrary cuts.

Based on the compensation norms set out in National Insurance Co. Ltd. v. Pranay Sethi, the Supreme Court reinstated the monthly income of the deceased at ₹62,725 and used the proper multiplier method for computation of compensation. Consequently, the total compensation figure was re-determined to ₹1,20,84,925, with a 9% annual interest rate. Through this decision, the dependents of the deceased were fairly compensated according to recognized legal principles.

Statistics And Figures

Road Accident Statistics in 2022

According to the "Road Accidents in India 2022" report by the Ministry of Road Transport & Highways, India recorded 461,312 road accidents in 2022, resulting in 168,491 fatalities and 443,366 injuries.

Trends in Road Accidents and Fatalities (2018-2022)

|

Year |

Total Accidents |

Total Fatalities |

Total Injuries |

|

2018 |

467,044 |

151,417 |

469,418 |

|

2019 |

449,002 |

151,113 |

451,361 |

|

2020 |

366,138 |

131,714 |

348,279 |

|

2021 |

412,432 |

153,972 |

384,448 |

|

2022 |

461,312 |

168,491 |

443,366 |

Motor Insurance Claims Settlement Ratios

As of January 2024, the claims settlement ratios among major car insurance providers in India were as follows:

- SBI Car Insurance: 100%

- HDFC ERGO Car Insurance: 99%

- Royal Sundaram Car Insurance: 98.6%

Analysis:

The claim settlement is the most important sector of the automobile insurance business because it indicates the effectiveness and credibility of the insurance firms. For 2024, Indian insurance firms have given very good claim settlement ratios with SBI Car Insurance leading at 100% followed closely by HDFC ERGO at 99% and Royal Sundaram at 98.6%. These figures reflect a strong claims settlement procedure, guaranteeing that policyholders are reimbursed on time and financially compensated following an accident.

A high claims settlement ratio reflects the financial stability and customer service efficiency of an insurance company. SBI’s 100% settlement ratio suggests that all valid claims filed with the company were successfully resolved, which enhances its credibility among policyholders.

Likewise, HDFC ERGO and Royal Sundaram's high settlement ratios reflect that their policyholders face negligible delays and disputes in settling claims. But however, despite the fact that a high ratio of settlement is positive, this does not take into account situations where the claims are rejected based on procedural shortfalls, non-disclosures, or inadequacy of documentation.

Road Deaths

India experienced approximately 1.73 lakh (173,000) road accident fatalities in 2023, which translates to 474 fatalities per day or 20 lives lost every hour, ranking it as one of the riskiest countries for road users.Two-wheeler drivers caused nearly half of the fatalities, emphasizing the dangers of reckless driving, poor road conditions, and helmet non-use. Close to 20% of fatal car accidents were pedestrian-related, calling for pedestrian safer infrastructure and urban planning improvements.

The Motor Vehicles Act of 2019 prescribed harsher punishment for mobile offenses, compensation in the event of a hit-and-run accident, and good samaritan cover.

Yet, lack of uniform enforcement, inefficient judicial procedures, and administrative hold-ups in insurance claims still hold back its success. Legal professionals are calling for the establishment of fast-track courts for accident cases, AI-driven traffic policing, and improved road planning to stem fatalities.

The financial cost of road crashes is put at 3-5% of India's GDP every year, including medical expenses, lost productivity, and property loss. India needs to strengthen law enforcement, enhance road infrastructure, emergency services, and evidence-based traffic management systems to contain this crisis. Implementing best international practices like Vision Zero, which reconfigures roads with safety as a priority, may go a long way in preventing deaths and reducing Indian roads' fatality rate.

Judicial Inconsistencies in Contributory Negligence Rulings

Contributory negligence is one of the most criticized elements of motor accident claims because it has been inconsistently applied across various High Courts and tribunals. The Supreme Court itself has established established principles for quantifying contributory negligence, yet lower courts, at times, interpret these same principles to have drastically different impacts on claimants in the very same situation.

For example, in Kusum Lata v. Satbir, the Delhi High Court lowered the compensation given to a pedestrian who was struck by a speeding truck on the grounds that she crossed the road at an unauthorized location.

But in Municipal Corporation of Greater Bombay v. Laxman Iyer (2003), the Supreme Court decided that drivers have an enhanced duty of care to pedestrians even when they walk across the road where there is no zebra crossing. Such conflicting interpretations lead to uncertainty, and it becomes problematic for claimants to be able to foresee how contributory negligence will affect their award.

The inconsistency of judicial findings serves to emphasize the need for more specific statutory rules. Though the Motor Vehicles Act, 1988, contains a general outline of determining liability, it fails to delineate contributory negligence specifically and also not fixed norms of assessing the degree of fault apportionment. There remains legislative vagueness and consequently space for judicial flexibility that occasionally sees claimants get low settlements for meager or tenuous contributory negligence claims.

Comparative Perspectives: Contributory Negligence in Other Countries

Indian contributory negligence policy, as per the comparative negligence framework, is comparable to global best practices but deviates in terms of judicial treatment. Comparative analysis of how contributory negligence is treated in different legal systems provides valuable insights into suggested reforms.

United Kingdom: The contributory negligence in the United Kingdom is provided for by the Law Reform Act, 1945, as per which the claimants may recover compensation notwithstanding their partial liability. The contribution of negligence would be decided upon by the courts after a serious consideration of facts so that proportionate reductions are made in the compensation in light of the claimant's fault.

The decision in Froom v. Butcher established an important principle in that it was held that a breach of a seatbelt rule would diminish compensation but would never constitute a defence to liability per se.

United States: The United States has a varied set of contributory negligence rules, with pure contributory negligence or comparative negligence (which permits claimants to recover damages even if they are partially at fault) being employed in some states. The Li v. Yellow Cab Co. decision established California's pure comparative negligence regime, which prevents victims from being denied compensation entirely because of minor mistakes.

Germany: German law adopts a moderate comparative negligence system based on the Bürgerliches Gesetzbuch in which liability is apportioned according to the fault assessment. Before assigning contributory negligence, courts evaluate external causes such as road conditions, driver training, and mechanical flaws.

As AI plays an increasingly important role in contributory negligence rulings, legal and ethical concerns about its use to accident claims must be addressed. One of the biggest concerns is that AI may over-attribute negligence to claimants where human judgment would consider extenuating factors. AI is based on rigid algorithmic reasoning and has no capacity to understand complex legal and ethical factors.

For instance, an AI system will automatically identify a pedestrian as contributorily negligent if it detects that the pedestrian crossed the roadway outside of a marked crosswalk before being struck by an automobile. However, a human court would determine liability more fairly by taking into account other relevant circumstances, such as whether the motorist was speeding or if there were enough pedestrian crossings in the crossing location.

The admissibility of evidence produced by AI in court is another urgent matter that needs to be scrutinized carefully by the law. Most AI liability evaluation tools are created by private companies and run on proprietary algorithms, so neither courts nor claimants have complete insight into how these tools arrive at their conclusions. If a claimant's compensation is lowered on the basis of contributory negligence established by AI, they must have the right to question the processes employed by the AI system.

Courts need to set guidelines necessitating AI models applied in cases of motor accidents to be explainable, transparent, and subjected to third-party audits. Legal provisions must be in place allowing claimants to cross-examine AI-established findings so that assessments of liability do not become unjust and unaccountable.

A second ethical concern is the ability of AI-driven contributory negligence analysis to unduly penalize poorer claimants. AI models employed by insurance firms are designed to limit pay-outs, such that claimants without counsel might find it hard to oppose AI-based determinations of liability.

More affluent claimants, however, might have recourse to independent forensic experts who can challenge AI determinations, potentially tilting the balance of how contributory negligence is determined across socio-economic divides. To avert such discrepancies, courts need to require AI-determined liability determinations to be independently examined, especially when the claimant does not have the means to challenge the insurer's determination.

To meet these challenges, policymakers and legal scholars have demanded that AI ethics frameworks be developed for use in motor accident litigation specifically. Those guidelines would create minimum standards for transparency in AI systems deployed in liability determinations, mandate independent scrutiny of AI-driven contributory negligence decisions, and protect claimants' access to challenge algorithmic decisions in court. The more AI enters legal decision-making, the more imperative these actions will be to ensure fairness, accountability, and public confidence in the justice system.

The Link between Contributory Negligence and Criminal Liability

Contributory negligence is not only limited to civil liability and compensation cases but goes even a step further to affect the manner of court judgments in criminal liability cases of motor accidents. While contributory negligence largely determines the amount of compensation in civil proceedings, its application to criminal cases is complex.

In criminal matters, the court will have to determine whether an act of a driver comes close to criminal negligence under the Indian Penal Code, i.e., Sections 279 and 304A of rash and negligent driving causing death or injury.

When both the accused and the victim are guilty of causing an accident, it can result in one of the biggest legal issues. Is the vehicle driver criminally responsible if a pedestrian is killed after illegally crossing the road in front of a speeding vehicle, or does the negligence of the pedestrian reduce the responsibility of the driver?

Courts have mostly ruled that contributory negligence is not a defence for the accused in order to avoid criminal liability but may be a consideration of mitigation when awarding the sentence. In Alister Anthony Pareira v. State of Maharashtra, the Supreme Court ruled that while contributory negligence would reduce civil compensation, it will not absolve a driver of criminal responsibility if his actions were so reckless as to bring him to prosecution.

The difficulty for courts is to differentiate between instances where contributory negligence ought to bear upon criminal liability and instances where the accused's recklessness is so extreme that it overcomes any contributory fault on the victim. The criminal negligence standard has to be proved beyond a reasonable doubt, whereas civil contributory findings rely on a balance of probabilities.

The distinction between these standards of law renders the finding of a claimant contributorily negligent in a claim for damages ineffective in automatically minimizing the criminal responsibility of the accused. Nevertheless, there have been some High Court decisions that infer that contributory negligence can be taken into consideration when passing the sentence, rendering judicial reasoning across jurisdictions inconsistent.

Conclusion

The Supreme Court judgment in Prabhavathi & Ors. v. Bangalore Metropolitan Transport Corporation is a path-breaking verdict that enhances judicial protection for motor accident claimants. By affirming that contributory negligence has to be established on the basis of substantive evidence, the judgment protects victims of accidents from arbitrary diminution of compensation.

By aligning with best practices from the global scene, the inclusion of forensic science in the analysis of accidents, and appreciation of the socio-economic consequences of motor accident claims, the judgment brings about a more even and equitable framework for contributory negligence. In the future, this precedent will be instrumental in advising courts and helping accident victims get fair and open-minded adjudication.

FAQs

Q1: What is contributory negligence in motor accident claims?

A1: Contributory negligence occurs when the claimant is found partially responsible for the accident. In such cases, compensation may be reduced in proportion to the claimant’s degree of fault. However, courts require clear evidence before attributing contributory negligence.

Q2: How does AI help in accident claims and liability assessments?

A2: AI-powered systems analyze accident data, reconstruct collision scenarios, and assess driving behavior to determine fault. AI can speed up claims processing but also raises concerns regarding bias, transparency, and legal oversight in liability determinations.

Q3: How much do road accidents cost the Indian economy?

A3: Road accidents cost 3-5% of India’s GDP annually, including medical expenses, loss of productivity, property damage, and compensation claims.

Q4: What are the key legal provisions under the Motor Vehicles (Amendment) Act, 2019?

A4: The Act introduced higher penalties for traffic violations, compensation for hit-and-run victims, legal protection for good Samaritans, and electronic enforcement of traffic laws to reduce road accidents.

Q5: Why is India’s road accident fatality rate so high?

A5: Factors include high-speed driving, lack of helmet and seatbelt compliance, unsafe pedestrian infrastructure, delayed emergency medical response, and weak enforcement of traffic laws.

Q6: What is the conviction rate in road accident cases in India?

A6: While exact national figures are limited, legal experts note that convictions remain low due to delays in judicial proceedings, insufficient forensic evidence, and out-of-court settlements.

Q7: How can insurance claims be affected by contributory negligence?

A7: If the claimant is found to have contributed to the accident, insurers may reduce or deny compensation based on the degree of fault. However, claimants have the right to challenge such findings in court.

Join LAWyersClubIndia's network for daily News Updates, Judgment Summaries, Articles, Forum Threads, Online Law Courses, and MUCH MORE!!"

Tags :Others