Expert Financial and Legal Advice

Join 1,000+ Happy Customers

RECENT

Who Inherited Frank Sinatra’s Wealth after his Death?

Adjusted for today’s inflation, Frank Sinatra had a net worth of $300 million when he died. After his…

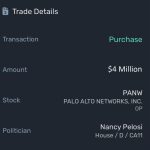

Nancy Pelosi and United Health: Suspicious Insider Trading

On February 21, 2024, UnitedHealth Group faced a significant cybersecurity breach that compromised the personal and healthcare data…

Sad Past of Greg Gutfeld’s Wife Elena Moussa

Greg Gutfeld’s wife, Elena Moussa, runs two profitable restaurants in New York and also owns many art galleries.…

Halcyon Ridge Island and Vanguard: True Theories

There’s an island called Halcyon Ridge, completely hidden from the outside world, controlled by a private organization called…

Chuck Schumer’s Net Worth Exceeds $81 Million

Chuck Schumer’s net worth is $81 million as of 2024. His enormous wealth can be explained by the…

Druski’s Net Worth and Cars in 2025

Profile Drew Desbordes (Druski) American Comedian and Actor $5 Million $800,000 (24%) Real Time Net Worth#72 in Comedians…

Karoline Leavitt’s $6 Million Net Worth and Salary

Karoline Leavitt has a net worth of $6 million. She earns a salary of $286,000 annually. Leavitt is…

Lacey Chabert Net Worth and Hallmark Income (FORBES)

You might recognise her from numerous movies on Hallmark, but Chabert has had long career. As of 2024,…

How Much Brian Cox Has Earned in His Career

Profile Brian Edward Cox English physicist and musician who is a professor of particle Physics $18 Million $3.7…

Double Taxation: A Hidden Price for Limited Liability

After understanding corporations and limited liability, you might wonder if it’s fair. If Bill had owned the cab himself and got sued, the soccer player whose career was ruined would have received…

Beginner’s Guide on Computation of Capital Gains Tax in India

Analysis of Section 48 The income chargeable under the head ‘Capital gains’ shall be computed by deducting the following items from the full value of the consideration received or accruing as a…

Unabsorbed Capital Expenditure on Scientific Research

What is Section 35(4)? For claiming deduction on account of deduction of capital expenditure on scientific research, it may be noted that the deduction of such capital expenditure shall be allowed to…

Computation of capital gain in case of zero coupon bonds

The Finance Act, 2005 has introduced the procedure regarding the taxation of the income on the Zero Coupon Bonds being issued on or after 1.6.2005. The provisions are as under: (1) Meaning…

TDS on Interest other than Interest on Securities

Who is liable to deduct tax [Section 194A(1)] The person (other than an individual or a Hindu Undivided Family) who is responsible for paying to a resident any income by way of…