Hello Friends,

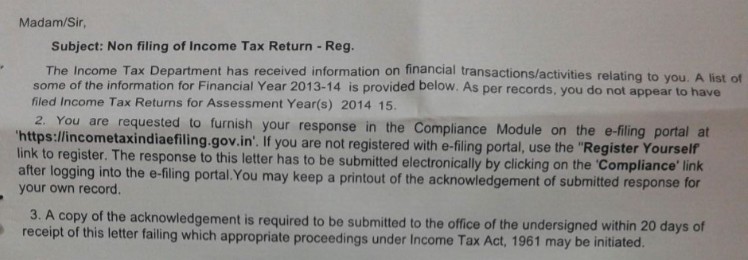

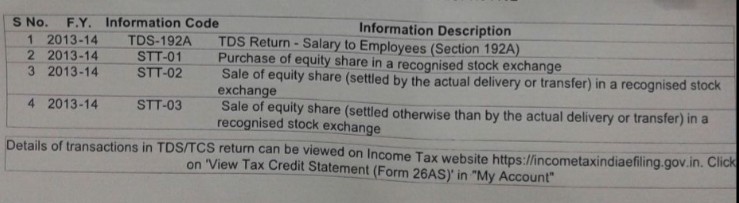

I received a notice from income tax stating that I did not file ITR for 2014-15 for the below transactions. I am employed and my ITR is normally filed by my employer and I receive form 16 every year. In the FY2013-14 I put 10000 in stock exchange and bhought some stocks for short term trading. I did this only for 2-3 weeks and sold all stocks. Now the notice I received is regarding that. I am attaching the content here, please suggest what needs to be done as this is the first time I am receiving some thing like this!! I got this letter from my home town Income tax office, but I am not there anymore I am working in Delhi. In this letter they have asked me to acknowledge in 20 days at the office.. What should I do for that??

Thanks in Advance

Emmanual