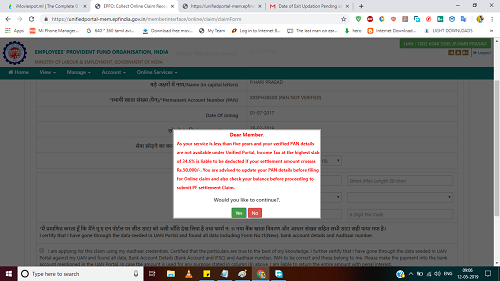

I have a continuous service of 9 years with 3 different companies and have 3 different PF no's which is linked and transferred to 2nd & 3rd succeding company under the same UAN No. Till date i had never withdrawn my PF amount, Now when i try to withdraw PF amount it say's PAN not verified, it also says that my service is less than 5 years so i will be attracted with a tax of 34.6% if my withdrawal amount exceeds more than 50,000. It displays my very last company's Date Of Joining & Date Of Exit in the portal. I have few questions & doubts and i need clariication from your expert panel.

1) I have a total 9 years of service so i need not need PAN verification as my total service period is exceeding 5 years. I also checked that there is a law that states as follows (Submissionof Permanent Account Number along with Form 15g/15H and Form 19 is excluded in cases where the EPF members have rendered continuous service of 5 years or more, including service with former employer)

2) As my service is 9 years why does the EPF portal shows my very last companies service period on the claims page.

3) When i approached the regional PF office in bangalore and explained about all scenerio they said that i can ignore the pop-up message and click "yes" to proceed further as it is a technical clitch on EPF portal itself. But i am sceptical about what if i proceed further by clicking "yes" and possibly if they deduct the 34.6% tax.

4) If they deduct my 34.6% tax due to failure of PAN verification, can i claim that back anyway from PF department?

Yours earliest reply is appreciated, I am helpless and sceptical about proceedfing further to claim my PF amount.

Regards

P.Hari Prasad

9620200111