I continue on the modus operandi of ICICI Prudential by explaining how your "application form" gets filled up, and how you end up with a "copy" of it in your "policy kit". As I mentioned before, the worker from NRI Services starts off with a pension plan that promises a guaranteed return of 13.4%, and shows a spreadsheet to convince you. At this point I have a NRE account, and a fixed deposit. But since I have returned back to India, and have to update my address, the worker says that the fixed deposit has to pre-closed. He takes Rs 5000/- from the fixed deposit ) for pre-closing the account. The interest rate was only about 3%, which went back to ICICI. The worker doesn't offer any options that will help me avoid the charge, and returns back with a flourish at having achieved something for his bank and possibly his bonus. Now he is onto his next goal, get this money "invested" in a "pension plan".

A honest person would have stated that this is a unit-linked plan, and the returns are subject to market risk. But not this worker. Anyway I take this worker's words on trust, and the next time I return, I'm in another worker's office, the so-called cluster manager of ICICI bank, equivalent to a branch manager.

When a bunch of crooks have hooked you with their scam, but you still haven't handed over control of your money, there comes a phase where the crooks want to hurry you through. So this cluster manager, says hurry up, the good plan will not be there after December (2009), and we are in the middle of December. He goes on to add, that if I apply now, I'll get more units for the money. I ask this worker, what units are you talking about, I've been told that this is a plan with a guaranteed return of about 13%. He quickly tries to cover it up by saying that, that is how they allot the money, and I need not worry about it, I will get the guaranteed return.

Although I had enough indication that these workers are not entirely honest, I didn't go with my gut feeling, a big mistake. The cluster manager, in a subsequent discussion, tries to make it like it was a communication issue, that the NRI services worker did not communicate properly. But that is not true, these workers (this includes the cluster manager himself) are trained to deceive, to bait, and switch, and later try and confuse the issue, so that it profits them, and the thing at the top, it's ceo, Ms. Chanda Kochhar.

I do sign a blank form, which I assume is the application form. It seemed more like a general questionnaire that you fill in. It did have health questions that would be required for life insurance, which apparently was not relevant in my case. I was promised that I would get a photocopy of this "application form" along with the policy kit. I also hand over the cheque, the first year premium of one lakh.

A week later, I get the policy kit, with a "welcome message" from an ICICI worker Ms. AP, who is an EVP (Executive Vice President, I presume) . This says "application form filled by you online after discussing the same with our representative". I do not know ICICI Prudential website, and during my visits there, no one sat before a computer and claimed to fill the application on my behalf. This "online application form" was filled by someone else, and when I was not around, quite possibly by some worker in Mumbai, not at my place, Coimbatore.

The reason why I believe the application was "electronically signed" in Mumbai is the lack of knowledge of the chosen "fund" by the local workers. The fund, Flexi Balanced (referred to as F. Balanced in the premium receipt, is however not mentioned in the "policy certificate"), was a mystery to the workers, the cluster manager included. It was a rope-trick, like balancing a big rock, on the top of a rope. Yet its complexity did not prevent the ICICI Prudential workers from inventing several "flexis", an unversioned Flexi Balanced, various other forms of "flexis" and then they had FB I, FB II, and so forth.

So I get the policy kit the last week on December 2009, I look at it, and it talks about market risk, with no mention of any guaranteed return. I take the kit, first week of January, and go to the cluster manager's office to get it cancelled. But this worker is adamant about not cancelling it, and offers a bunch of reasons. I ask for details about the plan that I was enrolled in, the workers state it must be "Flexi Balanced I". But when I ask for its NAV, it has no relation to what is in my premium receipt. They check out other "Flexi" funds, and after about 20 minutes, they end up with the unversioned "Flexi Balanced", and give me an account statement upto Dec 31st, 2009. With 3 workers inside the cluster manager's office, and a few other workers outside, it took a good deal of time to figure out what the "F. Balanced" in the premium receipt stood for, so it is more likely that the "online application form" was filled elsewhere.

From a photocopy of the application form with my signature, we have made a great leap to an "online application form". This cannot be discussed without a few images, that I've attached to this post. This "online application" in the policy kit, at first appearance, you may be deceived into thinking is really the actual application form, that fell into something, was taken out, dried, and carefully photocopied. A clever piece of work!

Exhibit 1 shows a portion of the "application form", you can see how the font looks washed out, and hard to read.

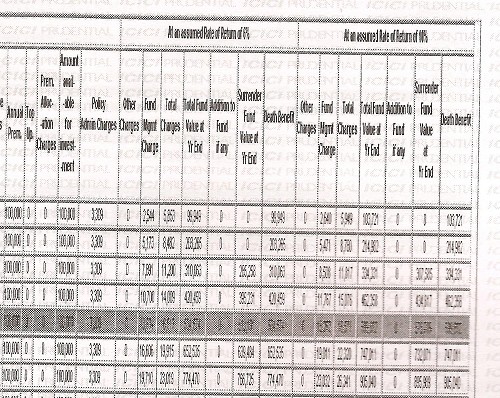

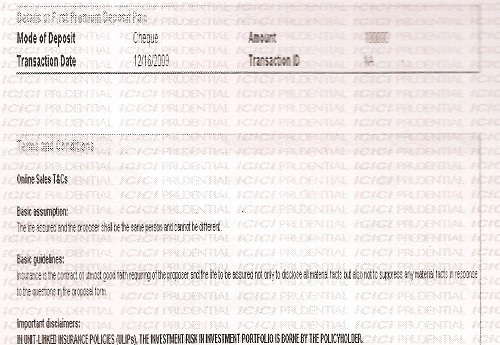

Now let us get to the Exhibit 2, EBI (Electronic Benefits Illustration), here you can barely guess the numbers for the fifth year. Apparently this EBI is very important, because one of the workers, Ms. BC, grievance redressal officer, mentions that they have a "duly signed EBI".

In this EBI, that shows your fund value, with assumed returns of 6% and 10%. With a 6% return, you actually end up losing money the first year, because the fund "management" charges eat up the returns. ICICI apparently has a "duly signed EBI", signed by me of course, which is a surprise, when the workers who sold the fund used enough deception to hide the fact that anything is market linked.

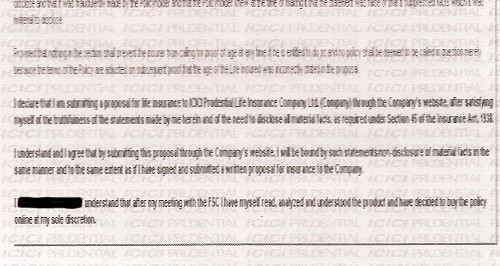

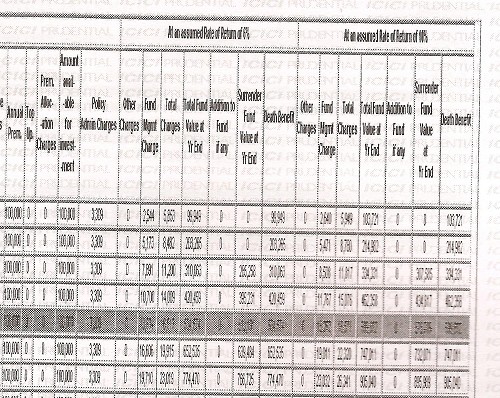

The "online application form" Exhibit 3 states that

"I declare that I am submitting a proposal for life insurance to ICICI Prudential Life Insurance Company Ltd. (Company) through the Company's website, after satisfying myself of the truthfulness of the statements made by me herein and of the need to disclose all material facts as required under Section 45 of the Insurance Act, 1938.

I understand and I agree that by submitting this proposal through the Company's website, I will be bound ny such statements, non-disclosure of material facts in the same manner and to the same extent as if I have signed and submitted a written proposal for insurance to the Company.

I XXXXX understand that after my meeting with the FSC I have myself read, analyzed and understood the product and have decided to buy the policy online at my sole discretion"

Now if someone were to get the personal information of the thing at the top, Ms. Chanda Kochhar, and make an "online application" that is binding on her, the local cyber crime sleuths would be at that person's door. But here is an organized entity that has done it, even quoting the Insurance Act, in the process, and profits off of it. How nice! The wonderful workers of ICICI have taken away all the hard work of hand signing the application, or of being around to read and fill the application. Every thing has been "electronically" done for you, behind your back.

If you believe this "online application", it seems that not only did I go online to the "Company's web site", I interacted with some entity "FSC" to do that. Now this is not the "our representative" that I was supposed to have discussed with as claimed by its EVP Ms AP on the very first page of the policy kit. What is this mysterious FSC, how did that thing show up, wherever I sat down to fill up the "application form", and how did "our representative" transform into this "FSC". What would be the relationship between ICICI, "our representative" and "FSC"? May be it pays for ICICI to cover up, if things go wrong, and blame some external "FSC".

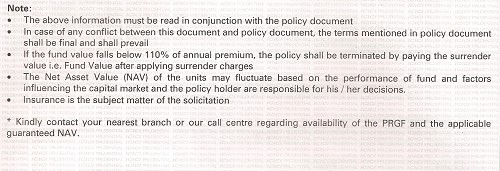

Look at Exhibit 4, the part of the "application form" that says in bold and clear "Examine the application form and inform us of any non-disclosure". That's really a bunch of thumb-sucking innocents, you are here to steal candy from these innocents, by "non-disclosure" on the "application form". How nice!

Now look at the text from "Key Feature Document", Exhibit 5, the text is so much easy to read. The note here, clearly states that "If the fund value falls below 110% of the annual premium, the policy shall be terminated by paying the surrender value i.e. Fund Value after applying the surrender charges" .

Why did the ICICI workers put this in the "Key Feature Document", was it to mislead the "policy holder" into thinking that the returns will be high? Why did they not apply this rule, since as far as I understand my "Flexi Balanced" fund was always below 110% of the annual premium. The workers could have admitted to this deception, or claimed that they missed out the fact that this applies only at the end of the third year onwards. That would have been a deficiency in their perfect world, so they just avoid answering any questions raised about this point.

The thing that is most apparent from the experiences of most people dealing with ICICI workers is that they are pathologically attracted to your money, like flies attracted to you know what. After a series of back and forth about getting my policy cancelled, one of the workers, the area manager Mr C, calls me up and says he wants to meet me and discuss the issue. I decline a face-to-face meeting, and ask him whether he understood the communication so far. It had been several months since I returned the policy document, and the next thing this worker says, now that the market is picking up, why don't you pay the next premium. The crudeness with this which this worker deals with the issue clearly shows that you'll get nowhere with these workers. All this worker can think off, is how to get money out of you, and profit himself and the thing at the top.

To add to all this a few months back, a lady calls from ICICI, and then proceeds to sell me a policy with a "guaranteed return". I listen to her carefully, but ask her to email me the details. She has my email address, linked to my ICICI bank account, so she says will email the details, which of course she doesn't. The "guaranteed return" bait-and-switch scam apparently doesn't work well when you put things in writing.

Sometime back I saw in https://www.grahakseva.com, a lady complaining about being misled about her policy by a worker from ICICI Prudential. In response an ICICI worker comes back all charged up and says that "We have received reports of certain unauthorized individuals posing as official representatives of the company or regulator contacting customers for pitching new policies... We will investigate and take strict action against individuals who are misleading customers by making false promises.". Here is our ICICI worker, a hero, ready to get on his flying steed, and pursue criminals who make false promises, whatever corner of the earth they may be hiding. But when the lady quietly adds , how is it that this "unauthorized individual" has so much information about you, the worker doesn't respond. Its a bummer, no global flights for this worker to pursue criminals, he has to park his steed for now.

Pension plans require you to keep paying money into the fund over a long period of time. Now the hard work of hand-signing the application has been eliminated, since the ICICI workers can "electronically sign" for you, you can just focus on handing over your money "through displined savings over a sustained period of time". This will "guarantee financial security of your family in the future". When it comes to ICICI you can simply be assured of it, after all the thing at the top was awarded the Padma Bhushan just a couple of years back.

I'll release more of the communication in the next few posts, and also discuss about the "foreclosure payout" of Rs 16,030/- on a premium of one lakh. There may not be any discussion about the account statement which shows how that number was arrived at, since it seems, that the ceo is not literate enough to understand my request for the account statement! Of course, ICICI doesn't provide the final account statment by default, too much work over and above the entertainment they provide!